Housing crisis in Michigan: Report explores who owns, rents, has no home; examines racial gaps

The burgeoning housing crisis affecting Michigan and much of the nation is addressed in a new report by the University of Michigan in partnership with the Michigan State Housing Development Authority.

"The data in the report reveals a landscape of critical challenges and opportunities in supply, demand, quality, affordability and stability," said Roshanak Mehdipanah, an associate professor of Health Behavior and Health Education and director of Housing Solutions for Health Equity, whose team gathered and analyzed the data.

"Against the backdrop of COVID-19 recovery, rising concerns over nationwide housing unaffordability and insecurity add urgency to our state's housing discourse."

The challenges remain especially profound for Black Michiganders who are part of a stark 34-point gap in home ownership that has 79% of white households owning their home compared to just 45% of Black households—one of many findings that highlight racial disparities.

"This is a clear indication that systemic inequalities need to be addressed," Mehdipanah said. "Addressing racial inequities in homeownership is critical in closing the racial wealth gap, as homeownership serves as an important means for intergenerational wealth accumulation and stability, offering families the opportunity to build equity, access credit and secure financial futures."

The report, "2024 Michigan Statewide Housing Needs Assessment," delves into a decade of data around the complexities of housing availability, affordability and accessibility—information city officials, urban planners, county commissioners, the public and anyone working in housing or in housing solutions can use to make informed decisions.

To that end, the report also details case studies that "highlight local innovations that respond to some of Michigan’s housing challenges." Each case study features a housing-focused organization's success story.

"Data such as reduction in tax foreclosure rates tells us there is promise in housing-focused interventions, particularly those developed and implemented with community organizations working closely with residents on these issues," Mehdipanah said.

David Allen, manager of the Office of Market Research at the Michigan State Housing Development Authority, said the intent of the assessment is to "provide pivotal data and analysis on a wide range of factors that impact Michiganders' ability to obtain necessary shelter."

"It can be used by a variety of stakeholders in the state’s housing ecosystem to better target resources and efforts to ensure that our families and individuals can enjoy a secure home, better health and a more inclusive economy," he said.

In addition to Allen and Mehdipanah, who is also co-lead for the Public Health IDEAS for Creating Healthy and Equitable Cities initiative, other authors of the report include U-M Housing Solutions for Health Equity team members. Kate Brantley is a research area specialist, whose work focuses on housing stability and eviction, and Melika Belhaj is the program manager whose research has focused on foreclosure, speculator behavior, naturally occurring affordable housing and low-income home ownership program outcomes in Detroit.

The group presented the report at the Building Michigan Communities conference this week.

"Our findings confirm what many already know—Michiganders with the lowest incomes disproportionately face the greatest barriers to securing safe and affordable housing," Belhaj said. "Our analysis reveals a 34-percentage-point homeownership gap between Black and white households, underscoring the lasting impact of U.S. housing policies, such as redlining, which imposed racialized segregation in the housing market."

The report is divided into four sections: housing inventory, housing demand, housing affordability, and housing instability and homelessness. Each section weaves in eight priority areas: equity and racial justice, housing ecosystem, preventing and ending homelessness, housing stock, older adult housing, rental housing, homeownership and communication and education.

In addition to examining data across a 10-year timespan, the analysis focuses on the years 2017, 2019, 2021 and 2022. According to the report, "these years mark pivotal points in the housing ecosystem: 2017, nearly two years after the tax foreclosure crisis began to subside; 2019, the year before the global COVID-19 pandemic; 2021, during the height of the pandemic; and 2022."

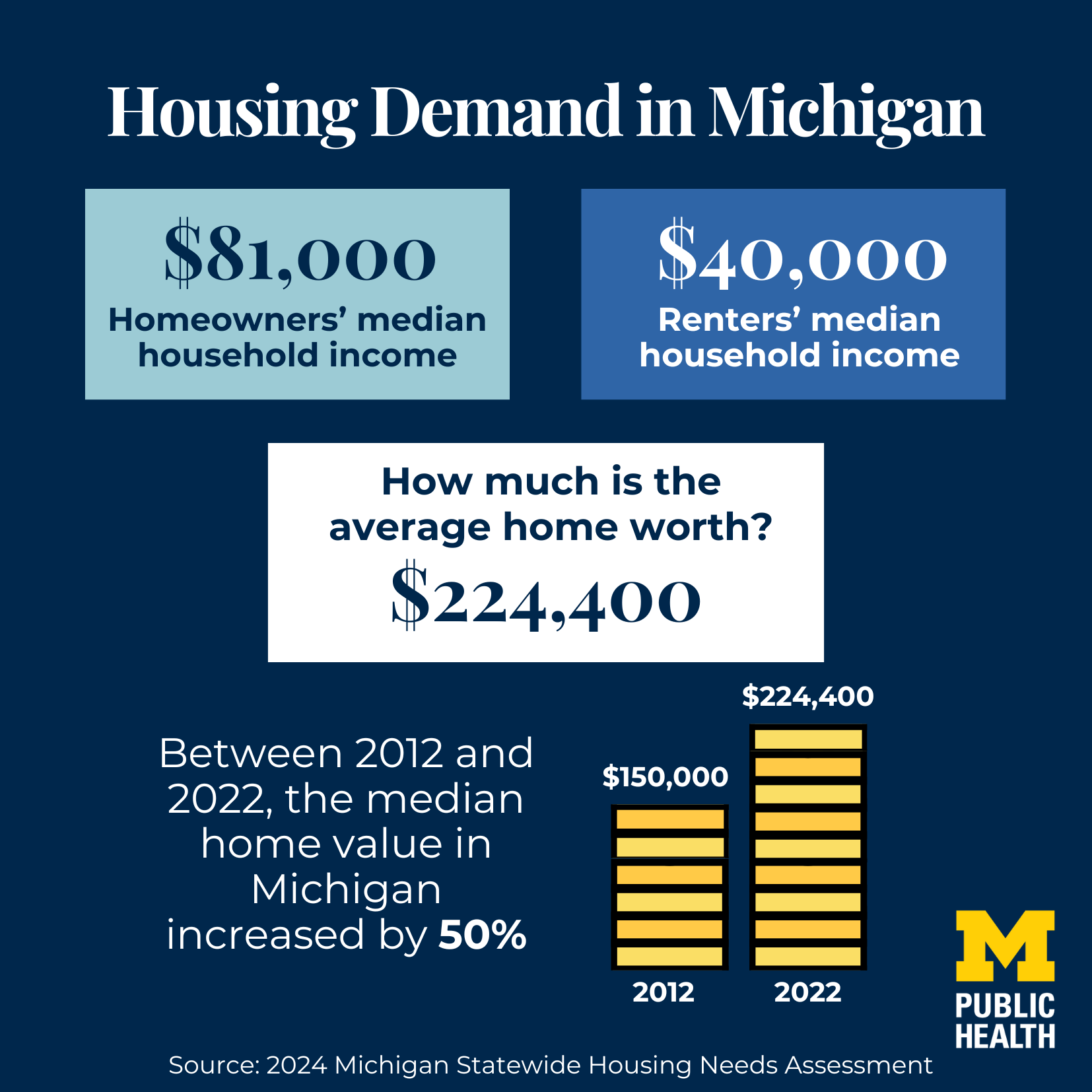

- $81,000 homeowners' median houshold income

- $40,000 Renters' median household income

- $224,400 is the average worth of a home

- Between 2012 and 2022, the median home value in Michigan increased 50%

- In 2012 the median home value was $150,000

- In 2022 the median home value was $224,400

*source: 2024 Michigan Statewide Housing Needs Assesment*

Key findings include:

- In 2022, 32,589 individuals were identified as experiencing homelessness, up 8% from 2021.

- Eviction filings increased by 38% between 2021 and 2022, after a significant drop in filings in response to the COVID-19 pandemic.

- Homeowners' median household income was just over $80,000, higher than the statewide median at $67,000, while renters' median household income of $39,000 was significantly lower than both the statewide and homeowner average.

- In 2022, 51% of renters were housing-cost burdened, or spending more than 30% of income on housing. This includes 26% of renters who were severely housing-cost burdened, or spending more than half of income on housing.

- Among homeowners, 24% with mortgages and 14% without mortgages are housing cost-burdened.

- 61% of all housing units were built before 1980. The federal government banned lead-based paint in homes in 1978, meaning the majority of housing units across the state today are at high risk of exposing tenants to lead and its risks to health, especially for children. Nationally, the number of homes built before 1980 is at 49%.

More positive findings include:

- From 2012 to 2022, Michigan experienced a notable 50% surge in median home values, now standing at $224,400.

- From 2019 to 2021, 25- to 34-year-olds in Michigan saw higher gains in the number of people heading households, compared to their younger and older counterparts. This change likely reflects life stages or milestones common among this age, including increased cohabitation, marriage and child rearing.

- Rising household growth among 25- to 34-year-olds may have been influenced by federal stimulus checks and student loan repayment pauses during the pandemic which provided opportunities to live independently as renters and homeowners.

- In 2022, the median household income across renter- and owner-occupant households jumped from $40,683 annually for those under age 25 and to nearly $76,000 for those aged 25-44.

- From 2012-2022, building permits for new construction of multifamily dwellings increased 4.4 times and made up 26% of total permits allotted, a departure from the state's historical pattern of predominantly single-family structure construction.

The research was funded in part by a $50,000 grant from U-M's Office of the Vice President for Research under the Bold Challenges Initiative, which supports research that applies a health equity lens to housing issues such as unaffordability, inaccessibility and quality. Other support comes from the U-M Poverty Solutions and the MICHR PACE grant.

- Housing Solutions for Health Equity

- Department of Health Behavior and Health Education

- See more about the current state of housing in Michigan

Media Contact

Kim North Shine

Senior Public Relations Representative, Health Sciences

Michigan News

[email protected]

313-549-4995